Austin Real-Estate Housing Market Forecast 2018

November 30, 2017 | Front Porch Realty

A Look Ahead – Forecast for Austin Real-Estate Housing Market in 2018

Houses For Sale – Should You Buy or Sell in 2018?

US Home Prices are still heating up due to lack of houses for sale. Its a national problem that’s been brewing for 7 years and it’s the worst for California. Yet with crisis comes opportunity for capable real estate investment people. Homebuyers will need to be creative to match their income and buying power to the lofty prices being sought for houses for sale in Boston, Los Angeles, San Francisco and the Bay Area, New York, Seattle, Denver, San Diego etc.

In this EPIC United States Housing Report with predictions for 2018 to 2020, you’ll discover the hottest markets, zip codes, get stats and understand the key fundamentals that are driving the real estate markets today. Is a housing market crash possible? See the post on the best cities to invest in real estate. Where can you find houses for sale with the best upside potential as an investment? See this post.

Housing Experts Predictions and a Lot More

Experts predictions are mostly rosy forecasts of markets from Los Angeles and San Diego to New York. Despite talks of housing bubbles, it’s happy times for sellers putting their house up for sale, but tough shopping for home buyers and investors.

Most real estate sales and real estate investment experts are predicting a strong year ahead for US housing in 2018 for the next 5 years. This post has numerous insightful charts, videos and perspectives to help you understand the housing market in 2018 and beyond.

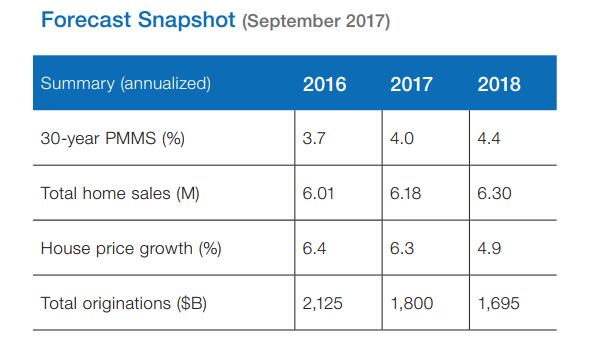

Let’s start off with the newly released 2018 Forecast from Freddie Mac. The predict a good year ahead with a solid 5% growth in price. They note that the aging population could keep demand subdued although limited housing for sale should create upward price pressure. The need to refinance is low, homeowners aren’t too stressed out, and they’re using home equity to buy things which is good for the economy. Overall, Freddie Mac’s report is positive for 2018.

The US Real Estate Forecast 2018 to 2020

November, December, January and the coming spring 2018 real estateseason should be interesting times. The economy is solid, trade deals look okay, new construction is active and recovering from the hurricanes in Texas and Florida, and the California fires.

Labor shortages and higher lumber costs are looming which could mean house prices could rise, and perhaps fewer resale houses will be for sale. If you’re buying or selling, check out the factors that will affect the housing market for the next 5 years.

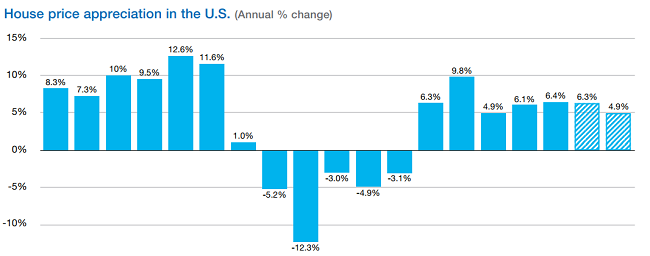

And as this graphic from Freddie Mac’s report shows, price appreciation is much less than before the last recession.

Hottest Real Estate Markets This Past Summer

Let’s look at the hottest housing market which is the city of Vallejo California. It’s a good example because it hints at where the opportunities are and where they aren’t. Vallejo, California was named by Realtor.com as the best city with the best outlook. Prices in nearby San Francisco and Bay Area housing market are so pricey, that buyers are willing to look to the north in Vallejo for what are ultracheap properties. As Vallejo’s neighborhoods improve, demand here could rocket for many years.

Best cities for finding houses for sale and get a great return. For investors or buyers with minimal cash, the cities of Kennewick, Detroit, Fort Wayne, Modestor, Fresno, and Waco look to offer the lowest prices on houses for sale.

| City Rank | Housing Market | Average Home Price – July 2017 |

| 1 | Vallejo, CA | $355,000 |

| 2 | Kennewick, CA | $225,000 |

| 3 | San Francisco, CA | $1,300,000 |

| 4 | San Jose, CA | $840,000 |

| 5 | San Diego, CA | $555,000 |

| 6 | Stockton, CA | $250,000 |

| 7 | Columbus, OH | $150,000 |

| 8 | Fort Wayne, IN | $50,000 |

| 9 | Sacramento, CA | 300,000 |

| 10 | Detroit, MI | $42,000 |

| 11 | Dallas, TX | $118,000 |

| 12 | Colorado Springs, CO | $255,000 |

| 13 | Yuba City, CA | $269,000 |

| 14 | Fresno, CA | $23,000 |

| 15 | Waco, TX | $83,000 |

| 16 | Modesto, CA | $26,000 |

| 17 | Denver, CO | $360,000 |

| 18 | Ann Arbor, MI | $320,000 |

| 19 | Santa Cruz, CA | $775,000 |

| 20 | Santa Rosa, CA | $530,000 |

In some markets such as California, home prices have leveled off a little from their relentless climb. There is a slight risk of a burst housing bubble. Outside of major city markets, the price growth potential in the next 5 years is highest. Some cities are hurting so invest carefully. Take a look at the best cities to invest in real estate and share your stories of which cities we should know about.

Here’s 7 Reasons Why People Are Still Eager to Buy Real Estate:

- home prices are appreciating

- millennials need a home to raise their families

- rents are high giving property owners excellent ROI on rental properties

- flips of older properties continue to create amazing returns

- real property is less risky (unless you get over leveraged)

- the economy is steady or improving (although Trump’s letting his enemies cause too much friction)

- foreigners including Canadians are eager to own US property

Latest real estate market reports:

There are more renters now than in the last 30 years.

US homes are at their highest value ever

Foreign buyers buying record number of properties

Housing starts more than expected but not enough to fill demand

New Houses for sale dropped 3.4% in August

Resale houses for sale drops in August

Buying and Selling — Is This the Right Time?

Are you selling your home in 2017? Speculation of a housing crash in Miami, Los Angeles, San Francisco Bay Area, Charlotte, San Diego, San Jose, Denver, Seattle, and many other overheated markets has more people listing their house or condo.

Expert Predictions – US Housing

1. Expert Prediction from Eric Fox, vice president of statistical and economic modeling (VeroForecast) — The top forecast markets shows price appreciation in the 10% to 11% range. The top forecast market is Seattle, Washington at 11.2%, followed by Portland, Oregon at 11.1% and Denver, Colorado at 9.9%.

These economies have robust economies, growing populations and no more than two month’s supply of homes. In fact, the forecast of the Boston market increase sharply to 7.4% is due to reductions in inventory and unemployment. On the other hand, the worst performing market is Kington, New York with 2.5% depreciation, followed by Ocean City, New Jersey at -2.1%, Kingsport, Tennessee at -1.9% and Atlantic City, New Jersey and San Angelo, Texas tied at -1.4%. — BusinessWire

2. Pantheon Macro Chief Economist Ian Shepherdson explains that “Homebuilders behavior likely is a continuing echo of their experience during the crash. No one wants to be caught with excess inventory during a sudden downshift in demand. In this cycle, the pursuit of market share and volumes is less important than profitability and balance sheet resilience.” — Marketwatch.

Can you save $1700 on Auto Insurance in one year? How about $10,000 in 6 years? That’s a lot of cash. Find out about getting a better auto insurance quote.

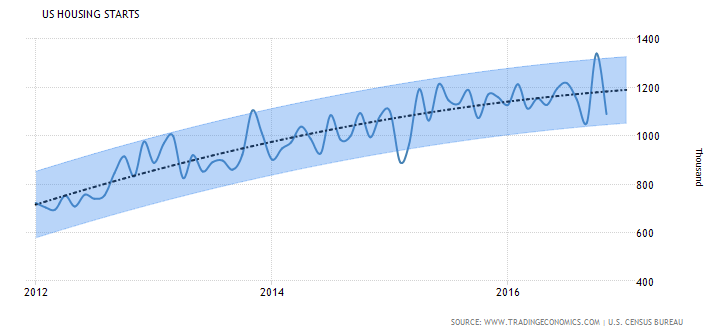

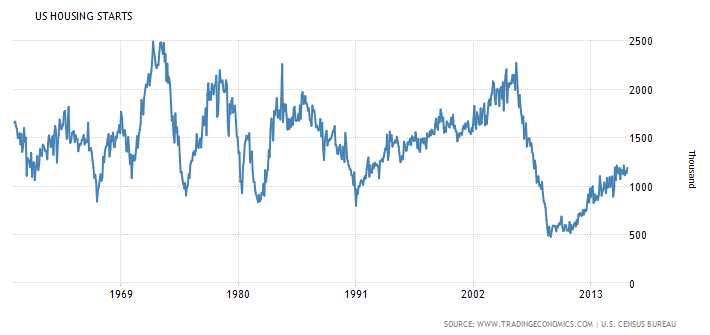

Housing Construction Starts Will Slowly Rise

It’s predicted that new home construction won’t keep up with demand, however it is recovering and we’ll see more renters becoming homeowners over the next decade.

US Housing Construction Starts All Time – on the Rise Again

US Housing Construction Starts All Time – on the Rise Again

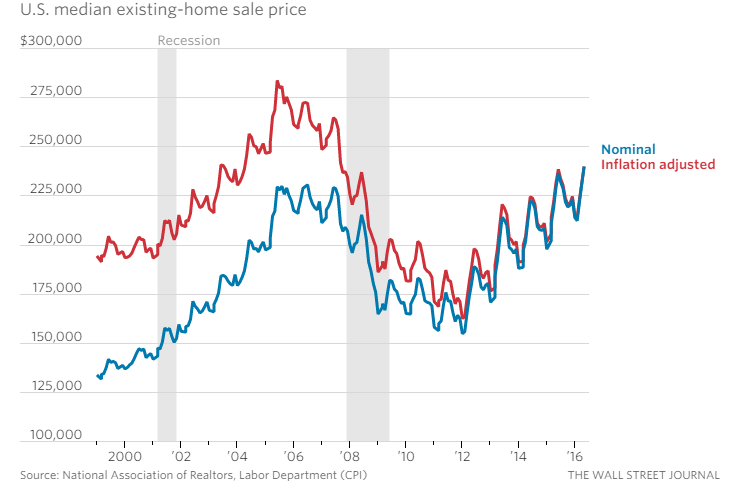

The right solution: Build more houses for sale. Let’s begin with a look at how home prices have grown up to 2016 and how that will drive new house construction. Nationwide prices are still $50,000 below the pre-recession highs. Will it take 3 to 4 more years to reach those highs? If construction rates do moderate, prices in the hot markets of Miami, San Francisco, Los Angeles, San Diego, New York, Boston, and Phoenix should rocket to all time highs but what is the risk of a housing market crash? House Renovation too is at an all time high in expenditure and this might have an impact on new housing starts.

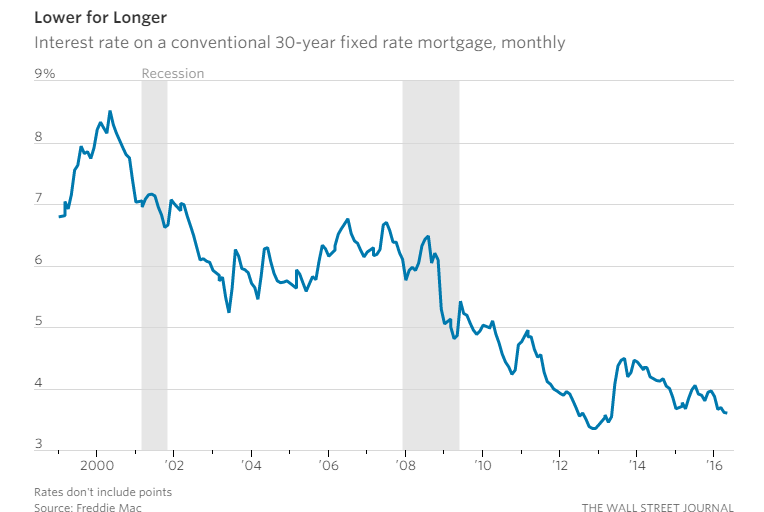

US Mortgage Rate Trends

US Mortgage rates are forecast to stay low. Yet recently, mortgage rates have risen above the 4% mark and homeowners are locking in their home loans at the 30 year period. Some are calling this the Trump Effect. With Trump in power, lending requirements are expected to be eased, land opened up for development, and this should stimulate home purchases. With employment growing and wages moderating upward, the market is set for growth. Yet, some housing forecasters still cling to the idea that housing starts will moderate after strong growth to 2020.

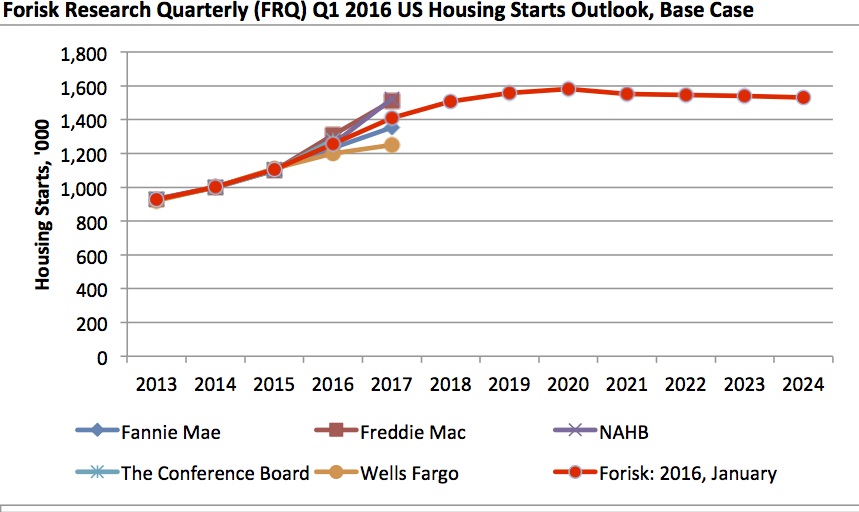

US Housing Starts to 2024

This enlightening stat in the graphic below shows the US economy hasn’t recovered from the great recession and housing crash of 2007. Single family spending is rising rapidly, yet no one believes conditions for high inflation exist. It points to years of solid, healthy growth ahead with an unfulfilled demand for single detached homes.

Graphic courtesy of paper-money.blogspot.ca

Graphic courtesy of paper-money.blogspot.ca

2016 Non Farm Payrolls

With the price of oil forecast to be rising again, it’s unlikely that economic winds will inflate wage demands. From 2017 on, wage demands should ease from their hot rates as you can see here:

Graphic courtesy of paper-money.blogspot.ca

Graphic courtesy of paper-money.blogspot.ca  Graphic courtesy of paper-money.blogspot.ca

Graphic courtesy of paper-money.blogspot.ca

US Housing starts are forecast to grow strong this year and next, particularly single family homes which will rise about 30%.

Chart stats courtesy of realtor.org

Chart stats courtesy of realtor.org

Austin Area Housing Market Statistics from October

Austin Area Housing Market Statistics from October

WANT TO SELL? CLICK HERE

AUSTIN, Texas – Nov. 14, 2017 – Single-family home sales increased across the Austin-Round Rock Metropolitan Statistical Area (MSA) in October, but declined in the city of Austin, according to the October 2017 Central Texas Housing Market Report released today by the Austin Board of REALTORS®.

Brandy Guthrie, 2017 President of the Austin Board of REALTORS® commented, “The Austin-Round Rock housing

2017 President of the Austin Board of REALTORS® Brandy Guthrie commented, “The Austin-Round Rock housing market continues to slightly outperform last year’s home sales activity, keeping 2017 on-pace for another record year for home sales. At the same time, low housing inventory levels along with constrained housing development activity throughout the city of Austin are preventing home sales growth at the city level.”

Single-family home sales in the Austin-Round Rock MSA increased 2.2 percent year-over-year to 2,292 home sales in

Single-family home sales in the Austin-Round Rock MSA increased 2.2 percent year-over-year to 2,292 home sales in October 2017. During the same time frame, single-family home sales in the city of Austin declined 1.7 percent to 699 home sales. At the county level, home sales volume increased 1.4 percent year-over-year to 1,124 home sales in Travis County, increased 5.4 percent to 794 home sales in Williamson County, and increased 6.2 percent to 274 home sales in Hays County.

Housing inventory levels continued to edge upward across the five-county MSA in October, increasing 0.2 months to 2.8

Housing inventory levels continued to edge upward across the five-county MSA in October, increasing 0.2 months to 2.8 months of inventory. In the city of Austin, single-family housing inventory increased 0.1 months to 2.3 months of inventory. Housing inventory levels across the region continue to be well within a seller’s market, compared to the Real Estate Center at Texas A&M University’s estimation of 6.0-6.5 months of inventory as a balanced housing market.

Gains in housing inventory throughout 2017 have been partially driven by strong housing development throughout much of the region. The Q3-2017 Austin Housing Report by Metrostudy released last month reported that new home starts in the trailing 12 months ending September 30, 2017, are at a 10-year high, with a majority of housing development activity concentrated in local markets surrounding Austin such as Pflugerville and the west side of Cedar Park/Leander.

“Developers and builders are beginning to experiment with lower-cost, higher-density products between $200,000

“Developers and builders are beginning to experiment with lower-cost, higher-density products between $200,000 and $300,000 in suburban markets, where products like townhomes and smaller single-family homes can be built more easily,” said Vaike O’Grady, Austin Regional Director for Metrostudy. “Shortages of vacant developed lots and regulatory hurdles in Austin make it difficult for meaningful housing development activity to occur within Austin’s city limits.”

Home prices continued to rise at a steady pace in October 2017. The median price for single-family homes increased 4.3 percent to $286,742 across the Austin-Round Rock MSA and increased 9.1 percent to $360,000 in the city of Austin during October.

Check out these other posts for homebuyers, investors, and realtors:

How to Sell Over Asking Price | 14 Ways to Improve Your Selling Price | When Should I Sell My Home? | Student Housing Investment | 10 Tips for Home Sellers Who Must Have the Best Price | Home Sellers Pricing Strategy | Better House Market Evaluation

Do the Underlying Economic Fundamentals Support Higher Home Prices?

Some think housing shortages will keep home prices high. However the economy is looking good and unemployment is low. This is a time when you can take changes to improve your life however, it’s wise to consider specifically where the real opportunities are. That might even include Real Estate Investing and investing in Rental Income Property. 30% to 40% ROI speaks pretty loudly!

![]() There are plenty of home buyers (Canadians and Chinese) out there if you’re considering putting your house up for sale. And especially first time home buyers this year. Millennials are hungry for housing. If you’re looking for support about the housing market fundamentals, keep reading below.

There are plenty of home buyers (Canadians and Chinese) out there if you’re considering putting your house up for sale. And especially first time home buyers this year. Millennials are hungry for housing. If you’re looking for support about the housing market fundamentals, keep reading below.

Housing experts are predicting existing home sales of 6 to 6.5 million units in 2017 and then above 1.3 million new homes being built per month from 2018 to 2024. The building is resuming now that the hurricanes and forest fires are over.

Will it be enough to support the economy? When American builders are feeling optimistic, it’s a good omen, however 1.5 million units per month is needed to fill forecasted demand for housing.

What’s also a good omen is what you’re going to read in this post. It may help you do many things in 2018, from finding employment (see the US Jobs forecast), to understanding politics, discovering high performing best investments 2017 to researching the best cities to live or buy houses or property in.

From Los Angeles to New York to Miami – Rental Property Equity/Income is King

Interest in rental income investment and apartments is particularly strong now in places like Miamic, Dallas, Seattle and San Francisco. The Los Angeles housing, San Diego housing, San Francisco Bay Area housing markets are just a few to look at. Seattle, Denver, Dallas, South Florida, Palm Beach, and New York have a promising outlook too.

See this post on investing in rental income property. Get some tips on how to do a better homes for sale search. Buyers might want to check out Canada given the excellent exchange rate. See the Guide to Buying Canadian Real Estate.

You won’t find too many US housing forecasts beyond 2017, yet we’re looking looking for the best cities to invest in real estate, where to buy a home, and whether this is a good time to sell your home. To see the future a little better, take a look at the Toronto real estate market, Calgary housing forecast , New York Real Estate Market, San Diego home prices report, and the market in the Bay Area. Find houses for sale in Los Angeles, and houses for sale in San Diego.

Here’s a short list of positive factors that will affect the US Housing Market 2017 and beyond:

- moderately rising mortgage rates

- president Trump’s new tax plan

- low risk of a housing bubble / crash for most cities

- millennials buyers coming into the main home buying years

- a trend to government deregulation

- labor shortages pushing up costs of production and incomes

- the economy will keep going – longest positive business cycle in history

The repatriation of business, investment and jobs back to the US may come with a big price — a high dollar and strong inflation. That will drive prices higher for houses for sale.

Check out the report on investments in rental property if you’re planning to buy in markets such as Los Angeles, San Francisco, San Jose, Silicon Valley, New York, Miami, Oakland, Phoenix, Seattle, Denver etc. Buyers are still dreaming in California a good look at the San Diego Real estate market, and the Los Angeles real estate market as economic indicators, and a fresh look at mortgage rates. To be on the safe side, see this post on the likelihood of a US housing market crash in the years ahead. Looking to put your house up for sale in 2018? Find a Realtor now.

Housing Stats from NAR, Forisk, Trading Economics

These stats below are collected from top research and reporting companies including NAR, Forisk, Trading Economics, and other real estate market researchers. The data reveals US housing starts and resales are on the rise 2017 to 2020 and beyond. And given the huge Generation Y have put off home ownership and are coming into their key buying years up to 2030, there will be a lot of pressure for babyboomers to put their houses up for sale.

Are you checking out home prices and the best zip codes to invest? Do you know how you’ll get the best price? Helpful posts for homeowners who want to ensure the best return on their key life investment, their home: 10 Powerful Tips for Home Sellers Who Must Have the Best Price and How to Sell Your Home for Above Asking Price. What are the best investment opportunties for 2017?

Sharing is Good for your Social Health!

Pass this blog post onto your friends and neighbors because they should know as much about the forecast factors as possible before they buy or sell. It’s good to be helpful. Mistakes are painful!

Employment Outlook: Let’s not forget jobs. Total employed persons in the US will grow 800,000 over the next 2 years.

Graphic courtesy of tradingeconomics.com/united-states/forecast

Graphic courtesy of tradingeconomics.com/united-states/forecast

Existing homes or resale home sales, may slow slightly but US construction spending will increase. Prices will rise to 2020 and construction spending will grow through 2020.

Graphic courtesy of tradingeconomics.com/united-states/forecast

Graphic courtesy of tradingeconomics.com/united-states/forecast

There you have a quick graphical synopsis of factors that will support a strong US housing market for 4 more years. Realtors who have feared investing in digital real estate marketing should calculate the long term value (LTV) of clients you build today.

What’s Your Personal Real Estate Sales Forecast?

Are you a full time realtor looking to grow your prospects and leads? Full service digital marketing is a bargain when it’s done well. What’s the forecast and trends for the real estate sales in your region? If you’re in Vancouver, Toronto, Miami, San Diego, San Francisco, and many other US centers, you’re probably grinning from ear to ear. But will you get your slice of that pie? Relying on real estate lead generation companies is another way you can go, however you have to pay forever and it’s questionable whether their leads are high quality.

My realtor marketing programs let you leverage the full mls listings with a powerful rets idx website, and capture more leads. I’ve enjoyed serving clients in Toronto, Boston, Chicago, Houston, Montreal, New York, San Diego, Los Angeles, Vancouver and San Francisco California, and you’ll be receiving the best possible digital marketing value possible.

Share this post on Facebook, Twitter, or Linkedin. It’s good to share!!